Week 13

I'm back to add another opinion on NFTs

Editor’s Note

I must admit that NFTs specifically, and crypto as a whole, annoy me. Maybe that is too soft of a word. They frustrate me. They incense me. Our civilization needs to be moving towards a dramatic reduction in energy usage and here we are doing a bunch of pointless math on computers stoked on by the libertarian VC wet dream of decentralized regulation. This POV was put on sharp display earlier this week when Balaji Srinivasan joined the Making Sense Podcast.

When you listen to the metaphors in Balaji’s line of thinking it at first makes sense. That’s part of the seduction. But when you interrogate it a bit more, to me, it is tomfoolery. For example, Balaji uses the metaphor of Uber/Lyft star rating replacing taxis medallions as an example of how regulatory bodies fail, insisting that instead of having the FDA approve drugs, we should put drug reviews on the blockchain so that you can actually get the drug trial data firsthand. “Makes sense,” you think at first,” Uber is a much better experience than ordering a taxi”. But upon further interrogation, you start questioning whether it was the medallion scheme that led to a worse consumer experience when ordering a taxi than when ordering an Uber. To me, it’s about being able to see the car on the map, reducing the uncertainty about when the taxi will arrive. I guess an alternative argument could be conjured up that the rating system allowed for more “taxis” on the road, reducing the consumer’s overall wait time, but I’m still not sure how this applies to pharmaceuticals. What I can tell you is that I’d rather not have to determine a drug’s safety and effectiveness using the same process as determining whether a restaurant is any good on Yelp.

Anyways, the whole podcast episode is worth a listen in order to gain an understanding of where the crypto enthusiasts are coming from and, like all great stories, they are based on a kernel of truth [Note: in the example above, Balaji does add that this decentralized consumer rating system of pharmaceuticals would require our DNA to be sequenced so that the sorting algorithm would only show us reviews from people with the same DNA markers], but as a whole, I think our best and brightest minds should be figuring out ways to help us adapt to extreme weather, not conspiring on thousands of new use cases to use more electricity.

That said, I am not a cynic about cryptos’ chance for success. When I think about cryptos' chances of making an impact on civilization, I think they are high (and not just because the compute needed to run the hashing will drive more coal usage, inputting carbon into the air, and impacting our chances of survival). My optimism for crypto’s chance of success is rooted in the story of Clarence Birdseye. Birdseye is credited with inventing the “quick-freezing” process of food preservation in the early 20th century. He was on a trip to Alaska and saw how the Eskimos flash froze Fish and wanted to bring that method to other types of groceries. But he couldn’t just invent the method and be done with it. Before we could have frozen veggies and dinners on every aisle, Birdseye needed to convince groceries to build freezers. Before grocery stores could fill those freezers, he needed to convince freight companies to create refrigerated storage. Put more simply, aspects of life that you take for granted today are the byproduct of a lot of elbow grease from a lot of elbows.

Crypto will be successful tomorrow due to the amount of money and effort being poured into it today. Funded by the libertarian VC, our best and brightest are leaving FAANG companies for crypto companies in droves. They are building out the refrigerated transport. They are putting the freezers into the aisles. Crypto will be part of your shopping experience whether you adopt it or not because the infrastructure is coming first.

To put this a bit more starkly let’s keep the metaphor of the grocery store and place a concept of crypto - the alignment of incentives - into a fictional grocery store of the future. But first, a bit of background.

Prior to 1869, two major forces drove purchases: price and availability. In 1869, a third force emerged: the brand. The concept of a “Brand” originally emerged out of a need to broker trust. Up until the late 1860s, everything that was sold had to be made locally. Otherwise, there was no way to verify its quality. In 1869, H.J. Heinz started selling horseradish, pickles, vinegar, and other condiments in clear bottles. He bottled them in clear glass so that customers could see the quality.

He also started affixing a sticker to each jar that read Heinz. That sticker is now commonly known as a logo. The Heinz logo allowed customers who didn’t know who Heinz was to still trust that the ketchup they were purchasing was legit. If it wasn’t, the brand would be damaged. Costing the brand much more than was to be gained by trying to sneak a sub-par bottle of ketchup by a customer.

Today, customers still primarily make decisions about which products to buy by price, brand, and availability. But through crypto, another force is emerging: fractional ownership. Fractional ownership is basically the same thing as a certificate of stock. When you buy a share of stock, you are buying a share of that company and, in theory, its future earnings. Fractional ownership is basically the same thing, but it doesn’t require a broker.

To understand how fractional shares will become a new force in consumption let us return to our grocery store of the future. In this future grocery store, just like today, for each type of item you want (e.g. soda) you are given a diversity of choice. When you make the choice about which soda to buy, you can take into account a few different factors: taste, price, brand identity. Fractional shares will become a fourth factor because when you make a purchase of that soda, your crypto wallet will instantly receive a deposit of a fractional share of that company, simultaneously re-aligning your relationship with the company that produced that product.

Prior to fractional shares, unless you owned stock in the company or were an employee, your incentives and the soda companies incentives were misaligned: You have money, the company has the product, and at the end of the transaction, the company has your money and you have the product. And then, by the time you finish that soda, you are out of money and product, your thirst only temporarily quenched.

Fractional shares realign that relationship. By receiving a share in the company with your purchase your relationship with that company is now ongoing. The more soda you buy, the more soda you get your friends to buy, the more fan art for that soda company you produce and share on the internet, elevating the brand and convincing others to buy, the more shares you have and the more those shares are worth.

Your incentives are now aligned with the soda company. This is an incredibly powerful concept because it changes the fundamental nature of exchange.

Another example where this will take place is activism. If today you want to save the polar bears, you can donate $10 to the Polar Bear Foundation to help with their efforts, but at the end of the donation, you have $10 less and the Polar Bear Foundation has $10 more, that’s it. You can post about it on social media, but it comes across as a post that says “I donated”.

With fractional NFTs, the Polar Bear Foundation can mint a one-off NFT in support of their cause and sell 100,000 fractional shares of that NFT for $10 each. At the end of the sale to you, the Polar Bear Foundation will still have the same $10 more, but you will have an NFT that you can use to more subtly virtue signal with on social media, and if enough people see that NFT and want in on the virtue-signaling action, your $10 donation could actually make you money!

(On a meta-point, I think fractional NFTs with be larger than fractional shares of tokens simply because the artistic nature of NFTs allows for culture to appropriate them and evolve them in ways not yet imaginable. Sharing ownership of a NFT on social is much more natural than announcing you own a certain fraction of a token. A fractional share of a token really is a lot like a stock certificate, except that you can imbue particular powers upon the owner of that stock, like access to a VIP lounge, but an NFT makes ownership much easier to signal, opening up adjacent possibilities for a whole assortment of payoffs)

This is the aspect of fractional shares or NFTs that really stands out to me: whether a purchase or donation, the payoff of that purchase (or donation) does not end with the consumption of the product. It is merely the beginning.

As today’s Clarence Birdseye’s build out the infrastructure (one could see Jack Dorsey and Square moving in the direction of our fictional grocery store sooner rather than later with their POS systems), this realignment will happen, whether we choose to adopt or not.

Anyways, sorry for the sprawling Editors Note and I know many of you are probably rolling your eyes thinking “not another crypto piece” if we even read it at all, but I was moved to add my 2 cents. I just hope that given the social nature of this type of realignment of incentives, companies will also be forced to offset all the additional energy use through the purchase of carbon credits and renewable energy infrastructure so we don’t dig the hole we are in even deeper.

What I’m Listening To

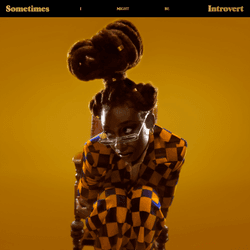

I was first introduced to Little Simz in 2015 when Kendrick Lamar gave her a cosign. The next year she released Stillness in Wonderland, a mix of soul, R&B, grime, and trippy, jazz-tinged interludes which were at times little muddled, but highlighted Simz lyrical agility. Then, in 2019, her sophomore album Grey Area felt like a transition welcoming her to the upper echelon of the rap world. Now, in 2021, with Sometimes I Might Be an Introvert, Little Simz has released one of the best rap albums, if not one of the best albums, of the year.

Sometimes I Might Be Introvert is as ambitious and intimate as anything the North-London MC has ever done. In her lyrics, she levels her successes by being herself, being introverted. And with that, she has made a record that prompts the kind of introspection that can lead to personal breakthroughs. It is also full of lush, expansive, and sprawling beats.

After first listen, “Woman” -a neo-soul ballad dedicated to the women of the whole world - is the stand-out track. Backed by Cleo Sol, her poetry is the image of her vision of the world. Another favorite is “Two World Apart”, with a sample of Smokey Robinson, it is a high-flying Jazz-Rap lesson. But in all honesty, I think each song will be able to stand out on its own. It’s an album to listen to over and over.

Listen to it for the first time here

Worth Your Time

Magic and empiricism in early Chinese rainmaking (Harvard) - Rituals aimed at bringing rain have been common across societies. Even in societies with writing and sophisticated philosophical traditions, such rituals have persisted for millennia. Given the evidence that people perceived these protocols as technologies, why did they persist?

Community ≠ Marketing: Why We Need Go-to-Community, Not Just Go-to-Market (a16z) - Love the idea of ‘go-to community. Community is the “new” moat. Having a community helps protect against competitor companies or products entering your territory.

Tyler Cowen is the best curator of talent in the world (Kulesa.Substack) - Tyler Cowen is an economist that has spotted top talent in fields ranging from biotech to literature, often years before insiders. How does he do it?

Gimme the Loot! (Collisions) - In another example that NFTs are at the top of the Gartner Hype Cycle, a project that mints unique lists of items is getting all the hype this week. That’s it. A dynamically generated list of items has each one going for thousands of dollars. But here again, I do think opportunities exist behind the hype. In the case of Loot, creators have taken the list of items and began to visually render approximations of them. These renders become a new form of IP that could eventually be integrated into Fortnite, Roblox, Netflix, etc. Especially if these concept generators are supplemented with Tik Tok-like creator tools. I know these lists seem silly, but they are also integral to the type of bi-sociation creativity that Arthur Koestler talks about. So maybe there is something there.

Here's What the Future of NFTs Looks Like (Late Checkout) - A different take on why Loot gives us a generous glimpse into the future of NFTs.

Loot is a viral social network that looks like nothing you've ever seen (Platformer) - Aaannnd another take on Loot, this one by Casey Newton.

Tokyo Jazz Joints

About TOKYO JAZZ JOINTS

Japanese jazz cafes and bars are often hidden, insular worlds where time ceases to exist, spaces removed from the speed and chaos of the modern urban landscape. Tokyo Jazz Joints is a visual chronicle of this world; an attempt to capture and preserve, if only from our perspective, the transient beauty of these spaces.

The jazz cafe culture in Japan grew organically in the years after WWII, as venues where fans could gather and listen to the latest records from the United States and Europe. Imported records – let alone turntables and speakers – were a luxury few could afford in those days of recovery from the war. The act of going to a cafe and listening to a new release in a social setting became the norm for a generation of urban Japanese. At its height, areas like Shibuya and Shinjuku in central Tokyo had dozens of these cafes and bars scattered around the main station plazas.

Slowly, the cafes began to disappear as economic development continued and listening to music at home became the norm. Some establishments transformed into night-time only bars when it was no longer profitable to open for coffee-time. Fewer and fewer customers would spend leisurely afternoons immersed in jazz, books and coffee. As of 2015, there are approximately 130 jazz cafes and bars spread throughout the Tokyo Metropolitan area alone, a huge number compared to most cities, but down from the peak of more than 250 in the early 1970s.

Year by year, the old jazz joints around town close their doors as the men and women who own them age and their children move on to other more ‘legitimate’ or lucrative occupations. Tokyo Jazz Joints is our attempt to let you into this slowly vanishing part of Japanese culture. These are small, sometimes tiny, intimate locations where you can lose yourself in the world’s greatest music.

None of these establishments were contacted about the project before we visited. Philip’s photographs are a window into this jazz community, showing the shops and their owners just as anyone would find them